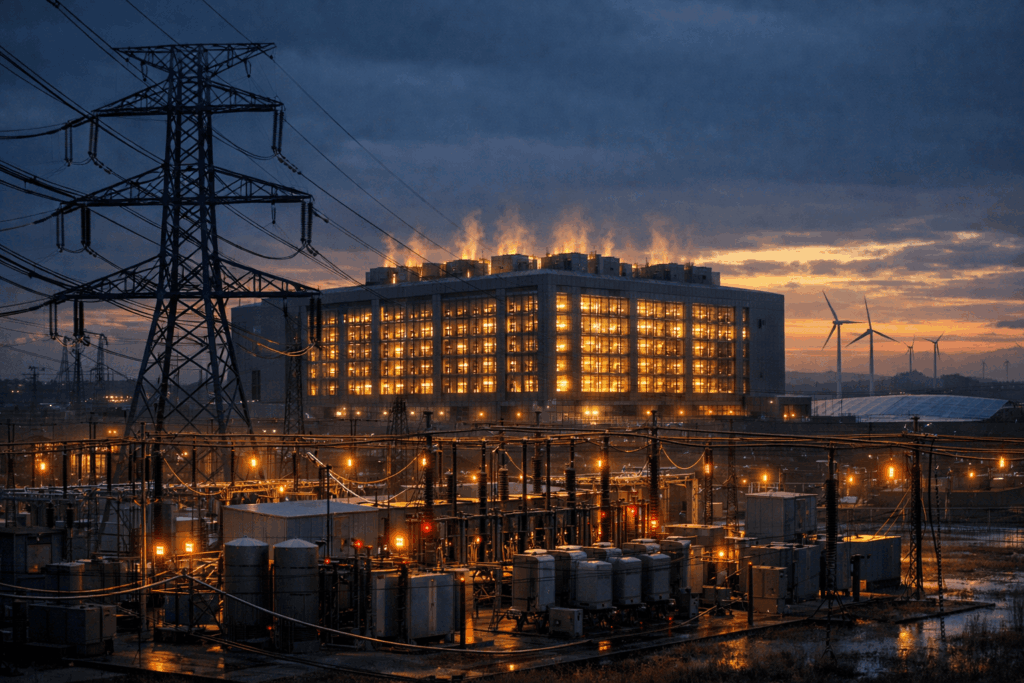

US electricity demand is entering its first period of sustained growth in more than two decades. After years of relative flatness, the Energy Information Administration now forecasts the fastest multi-year increase in power demand since 2000. Utilities report unprecedented volumes of large-load connection requests, with industry analysis suggesting that more than 160 GW of new large-load demand has been proposed or conditionally committed through the late 2030s. While not all of this capacity will ultimately be built, the scale and concentration of requests point to a structural shift in how electricity demand is growing.

The dominant driver is data centres. Government and independent studies estimate that US data centres consumed roughly 175-180 TWh in 2023, equivalent to around 4-5% of total US electricity use. Forward-looking scenarios suggest this share could rise to 7-12% by the late 2020s, driven primarily by AI and high-performance computing (HPC) workloads. This growth is not diffuse: it is geographically concentrated, highly time-sensitive and increasingly defined by individual facilities with IT loads of 100 MW or more.

Operators have made genuine progress in reducing facility overhead. Hyperscale providers now report fleet-average power usage effectiveness (PUE) values close to 1.1, compared with 1.25-1.4 for many legacy enterprise sites. For a 100 MW IT facility, this improvement can reduce non-IT power demand by 15–30 MW-a material efficiency gain. Advances in liquid cooling, power distribution and control systems have driven these improvements.

However, these gains are being overwhelmed by growth in IT power demand itself. AI accelerators consume several times the power of traditional CPUs, while higher rack densities push per-hall loads sharply upward. Lower PUE reduces overhead, but it does not reduce the compute load. In aggregate, total site demand continues to rise even as facilities become more efficient 🔌.

This reality has renewed interest in off-grid or behind-the-meter mitigation strategies. In practice, these face hard physical and economic limits. A 100 MW continuous IT load requires roughly 875 GWh per year of firm energy. Supplying this solely with on-site solar and batteries would require very large generation footprints and multi-day storage to maintain reliability-a scale that remains capital-intensive, slow to permit and operationally complex. As a result, most “off-grid” solutions today are hybrid systems, designed to support resilience or accelerate commissioning rather than materially displace grid supply. In the short to medium term, off-grid mitigation cannot offset the grid impact of AI/HPC growth at scale.

Some markets are better positioned than others. Regions with high shares of dispatchable low-carbon generation – notably the Nordics, parts of Canada and nuclear-heavy systems such as France – are accommodating data-centre growth with lower marginal emissions and reduced grid stress. These examples underline that grid composition matters as much as facility-level efficiency.

For business leaders, power availability, cost and carbon intensity are no longer operational details – they are strategic constraints. Decisions around data-centre design, location and cooling architecture now shape long-term operating costs, grid exposure and deliverability.

NovAzure supports energy suppliers and large energy users with bespoke modelling to quantify the real value that next-generation data-centre cooling technologies can deliver. Our analysis helps clients understand how innovative cooling can reduce electrical load, defer network reinforcement and materially improve total cost of ownership across competing cooling pathways. Contact Jean-Jacques Jouanna or Phil Cholerton for more information about modelling.

As AI-driven demand accelerates, leaders who rigorously evaluate cooling choices and system-level impacts will be best placed to secure capacity, manage risk and maintain competitiveness in an increasingly constrained energy system.